How to book capital contributions and withdrawals correctly

Business owners often transfer money from their company to their personal account, called an owner’s draw, or inject personal funds into the business, known as a capital contribution. For sole proprietors and partnerships, these transactions are fine if properly recorded, but failing to do so can lead to issues with the IRS and state tax authorities.

- 2 GB+ storage

- Sync across all your devices

- Spam filter and ad-free

How to do an owner’s draw and record capital contributions

When recording a capital contribution or withdrawal, two things are important:

- The value of the contribution or withdrawal.

- The accounts from which the money is paid or withdrawn.

This is crucial whether it’s a private withdrawal or a deposit.

To properly record these transactions, you need at least one personal account in your company’s chart of accounts. If multiple individuals in the company are allowed to make transactions between personal and business assets, there should be multiple personal accounts, which are typically sub-accounts under equity. In practice, many businesses use their own personal account for both withdrawals and contributions.

For owner withdrawals, you would record the amount from the personal account to Cash or another corresponding account. This is commonly referred to as an owner withdrawal journal entry. For private deposits, you would record from Cash to the personal account. When closing a personal account, withdrawals appear on the left (debit) side and deposits on the right (credit) side. This process is vital when understanding how to record an owner’s draw in your accounting system.

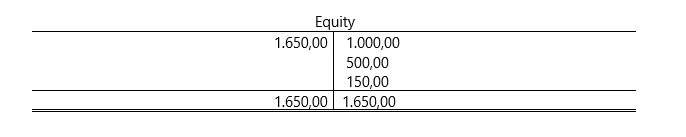

In the company’s balance sheet, owner draws are included under equity. Depending on the balance between withdrawals and deposits, you will either show a debit (more withdrawals) or a credit (more deposits) in equity. These owner draws on balance sheets impact equity, either as a liability or as a relief. Profit and loss also fall under equity.

How to record owner’s draws and capital contributions with examples

Now, let’s look at examples of booking cash contributions and withdrawals.

Booking cash contributions and withdrawals

When you withdraw or deposit cash between your personal assets and your business, you need a personal account as well as a Cash or Bank account.

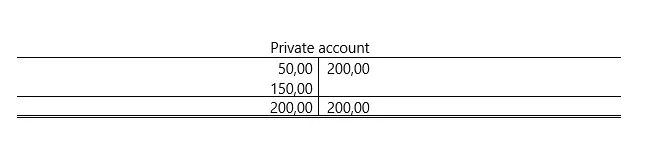

Example 1:

-

Withdraw $50 from the company’s cash register:

- Debit: Private Withdrawal (1800) $50

- Credit: Cash (1000) $50

-

Deposit $200 into the company’s cash register:

- Debit: Cash (1000) $200

- Credit: Private Deposit (1890) $200

Once the personal account is closed, the balance is reflected in equity.

Booking non-cash withdrawals

If you take a product for private use, you must register the list price, including any sales tax, instead of the acquisition or production cost. For example, if you take a chair with a net price of $119:

- Debit: Private Withdrawal (1800) $105

- $100 for the goods

- $5 for sales tax (at 5%)

This is also recorded similarly to cash withdrawals in the personal account and equity.

Booking usage withdrawals

If you don’t fully remove an item but use it privately (e.g., a company car), you need to calculate the private use value, typically based on a percentage of usage. For instance, if you use the company car for personal purposes, the U.S. IRS allows a flat 1% valuation of the car’s net list price per month for tax purposes.

Example:

- The car’s list price is $50,000. 1% of this is $500.

- 20% discount for business use = $100.

- Sales tax is calculated on $400 (after the discount).

- Sales tax at 5% = $20.

- The private withdrawal for the month is $520.

This would be recorded as:

- Debit: Free Levies $520

- $400 for personal use

- $20 for sales tax

- $100 for the flat rate business discount

Booking private contributions

Let’s now look at a private contribution example. Suppose you want to contribute a personal asset (like a PC) to your business. The book value would be the depreciated value of the item. If the PC originally cost $1,200 and is now worth $800 after depreciation, you would record it as follows:

- Debit: Other Operating Assets $800

- Credit: Private Deposits $800

Please note the legal disclaimer for this article.

- Free Wildcard SSL for safer data transfers

- Free private registration for more privacy

- Free 2 GB email account