Profit and loss statement (P&L)

The profit and loss statement, also known as an income statement, is part of the balance sheet and helps determine equity. As such, the P&L account appears on the liabilities side of the balance sheet. It not only provides you with an overview of your finances but is also crucial for investors and auditors, as it makes your company’s profit or loss transparent.

What is a profit & loss statement?

The P&L summarizes a company’s revenues, expenses, and profits (or losses) over a specific period, such as a month, quarter, or year. It includes key components like revenue (sales), cost of goods sold (COGS), gross profit, operating expenses, operating profit (EBIT), and net profit or loss. The P&L is essential for tracking profitability, making informed business decisions, attracting investors, ensuring compliance with auditors, and calculating taxable income. As one of the three main financial statements—alongside the balance sheet and cash flow statement—it provides a clear picture of a company’s financial health.

Who needs to prepare a P&L statement?

In the U.S., businesses are generally required to track their income and expenses to determine taxable profits or losses. The Internal Revenue Service (IRS) mandates that all businesses report their earnings for tax purposes, with specific requirements varying based on business structure. Corporations, partnerships, and businesses using accrual accounting must prepare a profit and loss statement as part of their financial reporting.

U.S. companies typically follow Generally Accepted Accounting Principles (GAAP), while multinational companies may also comply with International Financial Reporting Standards (IFRS). Businesses using double-entry bookkeeping must generate a P&L statement as part of their financial records.

The P&L statement is a core part of the annual financial statements and must be prepared for each fiscal year. However, many businesses create P&L reports more frequently—often quarterly or monthly—to monitor financial performance and respond proactively to negative trends. Additionally, publicly traded companies and larger corporations are subject to financial disclosure requirements under the Securities and Exchange Commission (SEC) regulations, meaning they must publish both a P&L statement and a full financial report annually.

The format of a P&L statement

There is no strict legal format for a profit and loss statement in the U.S., but businesses should follow Generally Accepted Accounting Principles (GAAP) for accuracy and transparency. The key requirement is that the statement is clear, well-structured, and complete.

For publicly traded companies, financial reporting regulations set by the Securities and Exchange Commission (SEC) require a standardized format, typically following the multi-step income statement format. Businesses are generally not allowed to offset (net) revenues and expenses unless specifically permitted under GAAP. The purpose of a P&L is to provide full transparency by listing all revenues and expenses separately.

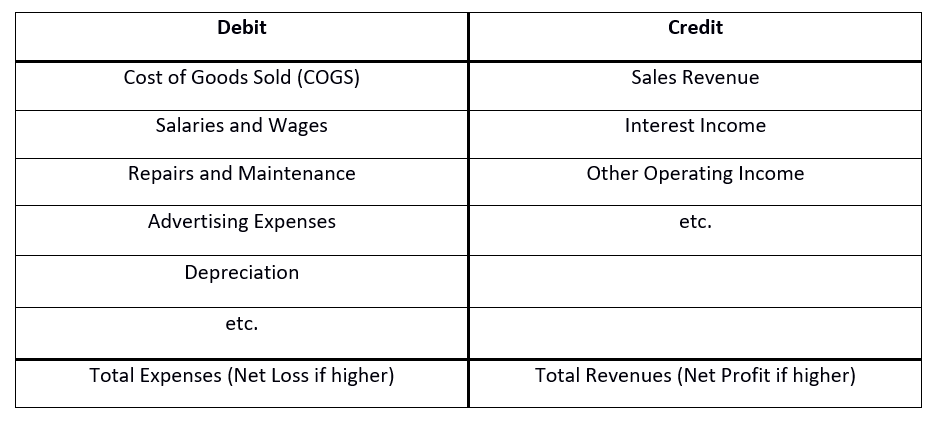

Account Format (T-Account)

The account format, also known as the T-account format, uses two columns: debit and credit. On the left side (debit), all expenses are recorded, while the right side (credit) lists revenues.

This format has the advantage of clearly displaying the relationship between revenues and expenses in a two-column layout, making it easier to compare totals than in a multi-step income statement. Additionally, the account format explicitly shows the total revenue and total expenses, allowing for a quick assessment of overall financial performance. Please not that the T-Account format is used for internal bookkeeping, not for formal financial reporting.

Profit and loss account

Multi-Step Income Statement

The multi-step income statement categorizes financial items into groups with subtotals, making it easier to analyze different components of a company’s financial performance. Each section represents a distinct stage in profit calculation, providing a clearer breakdown of revenues, expenses, and profitability trends.

This format improves transparency by separating operating income, non-operating income, and net income, allowing for better tracking of how profit or loss evolves at each step. The multi-step income statement is preferred for GAAP-compliant financial reporting.

How to create a P&L statement

Businesses use accrual accounting for financial reporting, but cash accounting is an option for small businesses. We take a look at both options in more detail below.

Cash Accounting Method

Under the cash accounting method, revenues and expenses are recorded when cash is received or paid, not when the transaction occurs. This method is simpler and typically used by small businesses with revenues under $25 million (IRS threshold for cash accounting eligibility), as well as sole proprietors, freelancers, and small service providers.

Example:

- A business sells a product in December, but the customer pays in January.

- Under cash accounting, the revenue is recorded in January, when the cash is received.

| Pros | Cons |

|---|---|

| Simple and easy to maintain | Not GAAP-compliant for most businesses |

| Good for small businesses and freelancers | Does not show accounts receivable or payable |

Accrual Accounting Method (GAAP Standard)

Under accrual accounting, revenues and expenses are recorded when earned or incurred, regardless of when cash is received or paid. This method is required under GAAP and is used by medium to large businesses and publicly traded companies.

Example:

- A business sells a product in December, and the customer pays in January.

- Under accrual accounting, the revenue is recorded in December, when the sale occurred.

| Pros | Cons |

|---|---|

| GAAP-compliant and widely accepted | More complex to manage |

| Provides a more accurate financial picture | Can show profits when cash is not yet received |

| Tracks accounts receivable (A/R) and accounts payable (A/P) |

How cash vs. accrual affects the P&L statement

Below is a comparison of how the same transaction appears in a P&L statement under cash and accrual accounting:

Example transaction:

A company sells a product in December 2024, but the customer pays in January 2025.

This is what the Cash Accounting P&L (2024) would look like:

Revenue

- No revenue recorded (payment received in 2025)

Total Revenue: $0

Expenses

- $2,000 Cost of Goods Sold (paid in December)

Net Loss: ($2,000)

This is what the Accrual Accounting P&L (2024) would look like:

Revenue

- $5,000 Sales Revenue (recorded when sale occurs in December)

Total Revenue: $5,000

Expenses

- $2,000 Cost of Goods Sold (matched to sale in December)

Net Profit: $3,000

The main differences are that under cash accounting, revenue is not recorded until the payment is received in 2025, leading to a loss in 2024. Under accrual accounting, revenue is matched to the sale date in 2024, leading to a profit in 2024.

How to create a profit and loss statement step by step

A profit & loss statement provides an overview of a company’s financial performance by summarizing revenue, expenses, and profit over a specific period. Follow these nine steps to create an accurate P&L statement:

Step 1: Select a reporting period

Determine the timeframe for your P&L statement. Most businesses prepare P&L statements monthly, quarterly, or annually for financial tracking and tax reporting.

Step 2: Record business revenue

Track all income sources, including sales, service fees, and other earnings. Categorize them clearly to maintain an organized financial record.

At the end of the reporting period, the sum of all revenue sources represents total operating revenue.

Step 3: Calculate the Cost of Goods Sold (COGS)

COGS includes direct costs related to producing goods or services, such as raw materials and direct labor, but does not include operating expenses like rent or marketing.

COGS = Beginning Inventory + Purchases - Ending Inventory

COGS is deducted before calculating gross profit.

Step 4: Determine gross profit

Gross profit represents revenue after deducting the direct costs of production.

Gross Profit = Total Revenue - COGS

Step 5: Identify operating expenses

Operating expenses (OpEx) cover business costs not directly tied to production, such as:

- Rent and utilities

- Salaries and wages

- Marketing and advertising

- Insurance and legal fees

Step 6: Account for depreciation and amortization

Depreciation applies to physical assets (e.g., machinery, office equipment), while amortization applies to intangible assets (e.g., patents, trademarks). It is is recorded as a non-cash expense to reduce taxable income.

(Asset Cost - Salvage Value) ÷ Useful Life

Step 7: Calculate operating profit (EBIT)

Operating profit, or Earnings Before Interest and Taxes (EBIT), reflects profit after deducting operating expenses, depreciation, and amortization.

Operating Profit = Gross Profit - Operating Expenses - Depreciation & Amortization

Step 8: Determine interest and taxes

- Interest expense – Includes interest from loans, credit cards, or business credit lines.

- Income taxes – P&L statements help determine the effective tax rate, calculated as:

Effective Tax Rate = Tax Expense ÷ Earnings Before Taxes (EBT)

The way that tax is reported depend on the business’ structure: C-Corporations should file Form 1120, sole proprietors & single-member LLCs should report on Schedule C, and partnerships & multi-member LLCs should file Form 1065 and issue K-1s.

Step 9: Calculate net profit (or net loss)

Net profit (or net loss) is the final amount left after deducting all expenses, including interest and taxes, from operating profit.

Net Profit = Operating Profit - Interest - Taxes

Please note the legal disclaimer for this article.