EBITDA margin: This is how easy it is to calculate the value

How profitably is your company running its daily operations? To answer this question, many companies refer back to the return on sales: the relationship between the annual net profit and overall turnover. In this calculation, however, different items are taken into account, which have no significance for the actual operations and therefore distort the result. With the EBITDA margin, you obtain a more realistic picture of the profitability of business operations in your company.

EBITDA margin: Definition and range of application

The EBITDA margin describes the relationship between the EBITDA business figure and the overall turnover. Unlike the net return on sales, tax, interest and depreciation items are not taken into account. The EBITDA margin gives information about the profitability of a company with regard to its business operations.

The acronym EBITDA is derived from the following formulation: "earnings before interest, tax, depreciation, and amortization". This figure describes the performance of a company, whereby interest, taxes and depreciation on fixed assets and immaterial items are not included.

There are two advantages with this figure: on the one hand, it enables isolated consideration of the operational activities of a company. The financial items that you exclude from the EBITDA have no direct effect on the success of the business operations. On the other hand, the differing taxation of companies often makes international comparisons difficult. If you leave these influences out, companies in different countries can be compared more easily with one another.

On the other hand, EBITDA also has the following weakness: Since it does not record depreciation on assets, it is difficult to derive predictions from it regarding the company's success. Production resources, for example, have only a limited duration and have to be depreciated in value and later replaced. A company’s economic context is also constantly changing, and the company must respond to this with new investments and the relevant depreciation. A company with a good EBITDA margin can certainly be pushed into the background because it neglects the necessary investments.

Keep an eye on activities

The EBITDA margin places the EBITDA in relation to the overall turnover: how does the income relate to the costs before taxes, interest and depreciation are offset? The percentage value thereby gives information about the profitability of the company in its business operations since it shows how much of the sales received (money made from the sales of goods and services) is initially left over. Manufacturing, sales and administration costs, for example, are related to the turnover.

Do not confuse the EBITDA margin with the EBIT margin, based on the EBIT (earnings before interest and tax), which includes depreciation. Furthermore, there is also the EBITA (earnings before interest, tax, and amortization) which is also related to it.

In general, the objective of a company is to keep its EBITDA margin as high as possible, for this indicates the low costs of day-to-day business in relation to the turnover. The EBITDA margin therefore also plays a major role when it comes to making savings on running costs: To improve this margin, cost savings have to be made on production, administration or staff, for example. The success of such savings is ultimately expressed in the EBITDA margin and not necessarily in the profit.

Ultimately, the EBITDA margin can also be used for an industry comparison. Different average EBITDA margins can be deployed within various industries. If you know these, you can easily estimate how profitably your own company is operating.

Calculating the EBITDA margin: This is how to do it

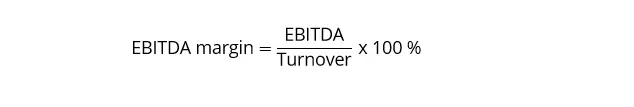

The EBITDA margin represents the relationship of the EBITDA to the overall turnover of a company. Therefore:

In calculating this, you use a full annual turnover. All revenue received from the sale of goods and/or services are relevant for this. The EBITDA includes these revenues as well as all expenses for the same period that can be directly applied: Material costs, manufacturing costs, rental and leasing costs, energy costs, administration and sales costs, etc. On the other hand, interest receipts and expenses, as well as taxes and depreciation of any kind, are excluded.

For the EBITDA margin to come out high, the EBITDA must be high in relation to sales. This means that the costs taken into account are comparably low. This is precisely why the EBITDA margin serves as a figure for the impact of savings with regard to operating costs.

The information required to calculate the EBITDA margin can be taken from the legally required profit and loss calculation.

EBITDA margin explained via examples

Two fictitious companies will serve as examples to clarify the calculation of the EBITDA margin: The first company achieved a total turnover of USD 1.5 million. After deduction of the directly applicable costs, the company has an EBITDA of USD 225,000. Thus:

The second company generated a much lower turnover. It recorded USD 800,000 in the previous financial year. The EBITDA is USD 144,000.

Despite the lower turnover, the second company has a higher EBITDA margin. This shows that the costs arising in the business operations are comparably lower. The company therefore operates more profitably day to day.

Click here for important legal disclaimers.