What is a limited partnership?

If two (or more) people want to set up their own business and open a company together, the first thing they need to agree on is what legal form to choose. Since a limited partnership is usually easier to set up than a corporation, the partnership is usually the preferred choice, since it doesn’t require a minimum capital contribution or any fixed capital holdings.

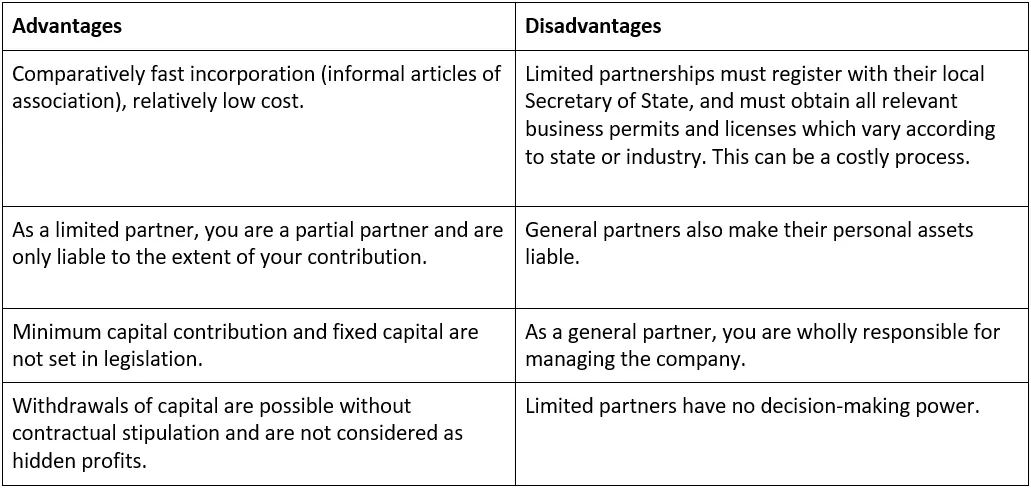

However, as they say, there is no such thing as the perfect legal structure. Each one has its own advantages and disadvantages. So what makes the limited partnership stand out, and what do you need to know about it? What are its advantages and disadvantages? Here, we will outline the answers for you.

What is a limited partnership? Meaning and origins

In a limited partnership, at least two individuals come together to jointly operate a commercial business. A limited partnership can be founded by two or more natural/legal persons. The special thing about limited partnerships is that there are different regulations for its shareholders regarding liability.

Two partners with different liabilities: the limited partner

The limited partner contributes a certain amount of money, known as a limited partner contribution, from their own funds when the company is founded. The amount of this contribution is not regulated by law and can be determined individually, in consultation with the other partners. In the event of insolvency, the limited partner is only liable to the extent of the contribution they made, so their private assets remain untouched. This means that the limited partner is legally limited in their liability. The prerequisite for this, however, is that the contribution (which can consist of both money and material assets) has already been made in full by this time.

This is the difference between how a limited partnership functions, versus a general partnership in which the partners are personally liable to the creditors for the company’s liabilities as joint debtors. For more information on legal definitions of limited partnerships, please visit the Cornell website.

Two partners with different liabilities: the general partner

Aside from a limited partner, a limited partnership must also have a general partner within the company. They are, however, fully liable to creditors i.e. with the entire assets of the company and, in an emergency, their private assets. Both a natural person and a legal entity can enter a limited partnership as a general partner – for example, a limited liability company (LLC) so that the original limited partnership becomes an LLC & Co.

If an LLC functions as the general partner of a limited partnership, a limitation to the general partner’s liability can be created. This is because the general partner’s liability is then limited to the LLC’s company assets.

Subsequently, general partners bear a much higher risk when setting up a limited partnership, but in return they have the right to manage the company on their own – in other words, they represent the company internally and externally. A limited partner is typically excluded from managing the company, but can be granted a power of attorney or procuration. These must be recorded as a deviation in the articles of association.

However, in 2001 the Revised Uniform Limited Partnership Act in Section 303 stated that the limited partner may exercise control over entity obligations and increase their personal liability. This places them on a par with general partners. However, not all states have adopted this federal legislation, so it is important to check with the state government where you are running your business to ensure that your company is legally watertight.

A limited partnership is a partnership founded by at least two natural or legal persons whose objective is to begin commercial trading. A limited partnership always consists of an unlimited, personally liable partner, called a general partner, and a partner who is only liable to the amount of their contribution – the limited partner. While the general partner, who is liable with his private assets, manages the company completely, the limited partner has no decision-making powers and is not obliged to be involved in the running of the company.

Advantages and disadvantages of a limited partnership

Just like any other legal form, the limited partnership also has special advantages and disadvantages which you need to take into account when picking a legal structure for your company.

A personal e-mail address is a prerequisite for professional email communication. Secure your desired e-mail address with its own domain name now with IONOS.

Limited partnerships – an example

A limited partnership offers shareholders numerous advantages and is particularly suitable for a family business. However, anyone wishing to become a general partner in a limited partnership should be aware of their responsibilities and consider the decision carefully. The following example illustrates the consequences of an ill-considered decision:

Jenny Smith has always dreamed of being her own boss. After careful consideration, she decides to go into business for herself by selling innovative office furniture. Tables that can be folded out and adjusted in height, office chairs with integrated massage functions, and lamps that adjust their light intensity according to natural light present – these are her planned bestsellers.

Her sister Annie and brother Alex are enthusiastic about the business idea and want to be part of it, contributing a considerable amount of money. Since Alex’s former classmate founded a limited partnership several years ago, Alex knows about the advantages of this legal structure and is able to convince Jenny to start a limited partnership. For Jenny Smith, it was clear from the outset that she wanted to run the company, so, as a general partner, she contributed around $30,000 to the “Smart Office” company. Her siblings Annie and Alex each have a role as limited partners, contributing $10,000, which they register as a liability sum.

Business has been good for about a year, and all the shareholders are satisfied with their profits and responsibilities. However, in their third financial year, numerous competitors appear in the market, offering significantly lower prices and consistent quality. “Smart Office” becomes insolvent and must pay debts to the value of $100,000. However, in addition to the existing limited partnership capital ($30,000 from Jenny Smith and $10,000 from each of her siblings) is not enough.

Annie and Alex each lose $10,000, thus fulfilling their obligation as limited partners of the limited partnership – their private assets remain untouched. However, Jenny Smith is a general partner and must pay the remaining $50,000 herself. It doesn’t matter whether or not she has sufficient financial means. Her car, house, apartment (i.e. her property) must also be used for repayment.

It would be useless to dissolve the limited partnership in this instance, since after the dissolution Jenny Smith still has to settle the debts using her personal assets. Anyone who wants to start a limited partnership with a general partner role should be aware of this risk and responsibility. Jenny Smith could have reduced her liability risk if she had started a limited liability corporation as a general partner. You can read more about this in our article on founding a limited partnership: liability, costs, and more.

Our article "forming a limited partnership" might also interest you.

Click here for important legal disclaimers.