Report new hires: registering new employees

If you plan on hiring new employees, you need several pieces of information from them for your records. Whether you’re about to hire your first ever employee, your hundredth employee, or maybe just some temporary help over the holidays, there is quite a lot that you, as the employer, have to bear in mind.

How to report a new hire quick guide

- Verify they can work in the US by having them complete Form I-9

- Have them fill out the W-4 form for federal payroll tax withholding

- Report the new hire to your state’s labor agency

- Get workers’ compensation insurance (requirements vary by state)

- Select a payroll method (e.g., manage payroll yourself, hire an accountant, or use a payroll service)

- Display employee rights posters around the office (including federal and state-specific posters)

- Free Wildcard SSL for safer data transfers

- Free private registration for more privacy

- Free Domain Connect for easy DNS setup

Ensure the employee is allowed to work in the United States

First things first: before hiring a new employee, you must verify that they are legally allowed to work in the US. Hiring someone who isn’t authorized to work can result in fines or criminal penalties. Here’s how to find out:

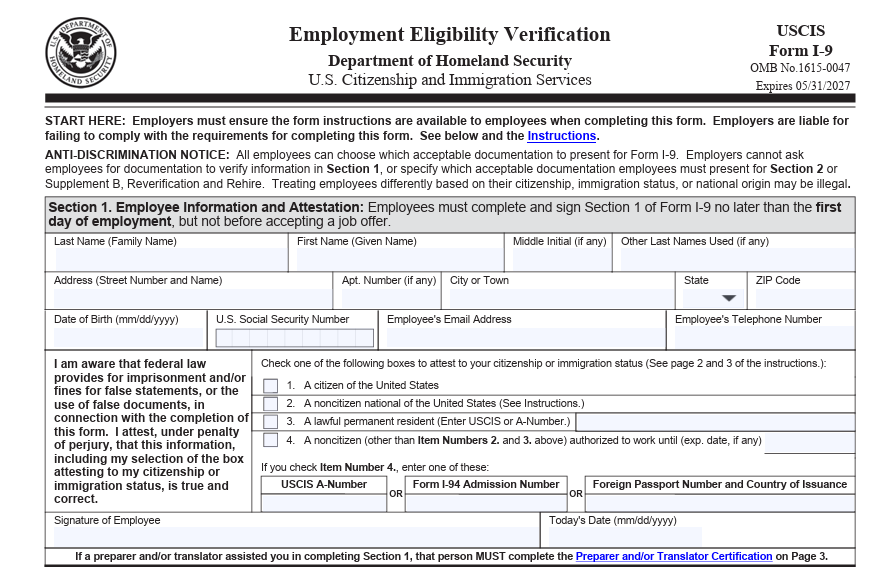

- Have the employee complete Form I-9: Employment Eligibility Verification before or on their first day of work to confirm they can legally work in the US. After they fill out the form, you will have their contact information, Social Security number, and employment eligibility status.

- The employee must provide valid documentation, such as a U.S. passport, permanent resident card, or a combination of two documents (e.g., a U.S. driver’s license and Social Security card) to prove their identity and employment authorization by their third day of employment.

The employer must ensure that all personal information collected during the hiring process, including Social Security numbers and other sensitive data, is stored securely and handled in compliance with privacy laws to protect employee confidentiality.

-

Form I-9 and supporting documents should suffice in most states. However, some states require employers to enroll in the E-Verify program, a system administered by the Department of Homeland Security (DHS), U.S. Citizenship and Immigration Services (USCIS), and the Social Security Administration. States such as Arizona, Alabama and Mississippi mandate E-Verify use, while South Carolina “encourages” employers to enroll. Other states, like Colorado, Idaho, Nebraska, and Rhode Island, require public contractors to use E-Verify.

-

Employers are not required to send Form I-9 to the federal government but must retain it in their records for three years after hiring the employee, or for one year after the employee stops working for your company (whichever comes later).

Have them fill out the W-4 Form

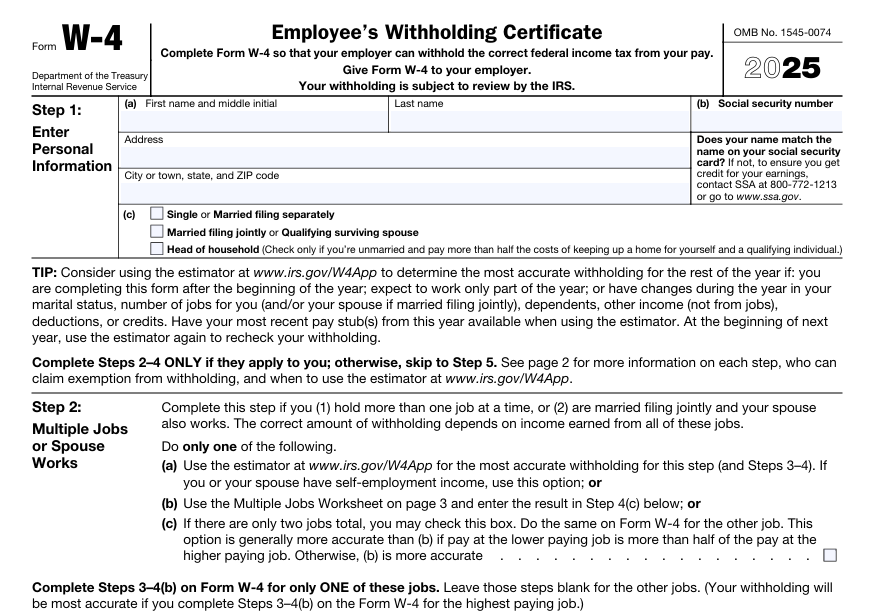

Every employee working in the United States needs to complete a W-4 Form (2019) so that the employer knows how much to withhold from the employee’s wages for federal income taxes. This is known as “withholding tax” or “payroll withholding”. From this form, the employer can determine the employee’s marital status, number of dependents, and additional deduction amounts. The form must be completed before the employee receives their first paycheck. What’s written on the form stays in effect until the employee makes changes, which they can do as often as they like. This could happen after receiving a bonus, for example, if they want to adjust the withholding amount. The employer keeps the form, but must produce it if requested by the Internal Revenue Service (IRS).

Let your state employment agency know about the new employee

After hiring someone, you will need to report the new employee to your state’s labor agency. Each state has an agency responsible for labor issues, unemployment benefits, and resolving disputes between employers and employees. By reporting the employee, the state can also more easily collect child support payments. It’s important to note that each state has its own reporting requirements, including deadlines and methods. For instance, Alabama mandates that employers report new hires within seven days, and employers with five or more employees must report online.

Sort out workers’ compensation insurance

Workers’ compensation requirements vary by state. In most states, it’s mandatory for employers to carry workers’ compensation insurance in case an employee is injured in a workplace accident or becomes ill due to work-related conditions. This insurance ensures that employees receive the necessary medical care and wage replacement if they are unable to work.

Choose a payroll method

Once you’ve hired your first employee, you need to set up a system to pay them. You can manage payroll yourself, hire an accountant, or use a payroll service. The latter option helps save time and ensures the process runs more smoothly. Payroll includes three main components: paying employees, paying payroll taxes (to the IRS and your state’s tax agency), and filing tax forms.

- Write perfect emails with optional AI features

- Communicate professionalism and credibility

- Includes domain, forwarding, and security features

Display posters on employee rights

According to the Department of Labor, certain notices must be posted in the workplace so that employees are aware of their rights. Some states have additional requirements for posters that must be displayed alongside federal requirements. These posters are available for free.

Are there any penalties for non-compliance?

Employers in the United States are mandated to report new hires to state agencies within specific timeframes, typically 20 days of employment, to facilitate child support enforcement and prevent unemployment fraud; failure to comply can result in fines ranging from $25 to $500 per unreported employee, depending on the state and whether non-compliance is deemed intentional.

Please refer to the legal notice for this article.