Travel expense report: template for download

When someone takes a trip, they mustn’t forget to complete their travel expense report once they get back. After returning from a business trip, the accounting department requires a detailed account of the costs that your trip incurred. This guarantees that you get the money that you spent back from your employer. You must pay attention to certain subtleties, otherwise you might not get any money at all, or possibly only after a long delay.

What is the purpose of a travel expense report?

If an employee goes on a business trip, i.e. has to travel to another location on behalf of the company – whether to a neighboring city or to the other side of the world – costs are incurred: tickets, hotel accommodation, meals. Some of these costs are already paid for in advance by the company and therefore no longer play a role in travel expense accounting. Others are incurred by the employee – and paid out of their own pocket. The accounting department can see from the travel expense report and the submitted receipts (very important!) what has to be reimbursed.

But not only the accounting department is interested in the travel expense report. It is also important for the tax office. After all, travel expenses are business expenses and therefore have an influence on the profit a company makes. And for the employees themselves, the tax office plays an equally important role during a business trip: If the employer does not reimburse the travel expenses, the employee can include the costs in their tax return. Detailed and correct documentation is a must.

The self-employed also use travel expense report forms – on the one hand for tax returns, because costs for business trips are part of the operating expenses. On the other hand, they sometimes pass on their travel expenses to their clients, who also expect complete documentation of the costs incurred.

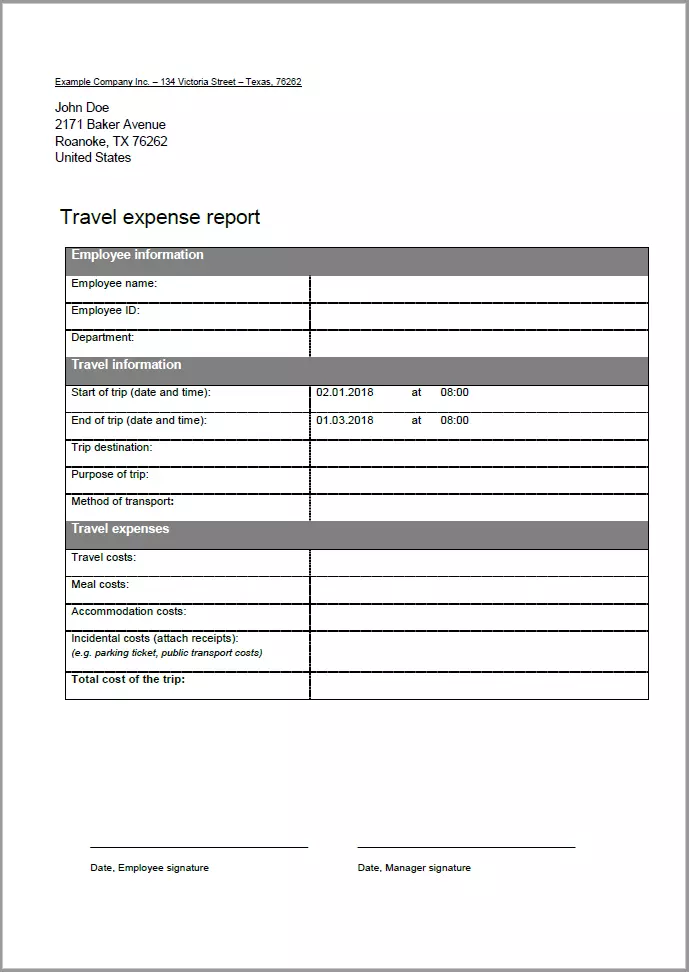

Components of the travel expense report – what the template should include

Four main sections are part of every travel expense report, therefore the template must contain them.

A detailed representation of all items in a travel expense report can be found in the text on travel expense reports.

- Travel expenses: Costs arise through using a company car, your own car, or from purchasing train, bus, or plane tickets. If you are traveling by company car, the employer usually insists that the employee keeps a mileage log. If you use your own vehicle, you’re often paid a flat-rate mileage charge for the sake of simplicity. Tickets for public transport must be kept in a safe place.

- Overnight expenses: When it comes to overnight expenses, you have the choice to either have the costs compensated by a flat rate or have them refunded via the receipts you submit. Ask for an itemized bill because minibar purchases and any movies you watch won’t be reimbursed by the employer.

- Additional costs for meals: When you are traveling, it is assumed that the costs are higher than when you eat at home. The Internal Revenue Service (IRS) generally allows 50% of the costs of meals on your business trip to be deducted from your taxes so don’t expect whole meals to be covered. For trips abroad, different rates apply depending on the destination.

- Incidental travel expenses: Incidental expenses include parking fees or toll charges, for example. It’s best to keep evidence of these too, if possible.

These four sections cover all costs that can be reimbursed after a business trip. Of course, there are further details to be included in the travel expense report:

- Full name

- Department

- Personnel number

- Start and end of trip with exact time of day

- Destination of the trip

- Travel purpose

- Means of transport used

- Signatures of claimant (employee) and supervisor

Travel expense report: template for your use

A travel expense report template facilitates the work for all parties involved and keeps the tax office happy. Both employees and the accounting department must be able to circumnavigate the document without any problems. Sections should therefore be uniquely named, which is the only way to avoid unnecessary mistakes. In addition, the sections should be created in an organized way. If the form isn’t designed in an easy-to-understand manner, a careless input can quickly mess up the whole layout.

Our travel expense report template is available as a free download in Word format. Employees can either print out the template and fill it out manually or complete the sections of the form directly on their PC.

Free Download

You can adapt the travel expense report template to your requirements as follows

Our template is created in Word and is best customized using Microsoft software. To be able to access all the functions you need, you must first display the developer tools. If these are not already available in the menu, switch to the options via the “File” tab and activate the extended functions in the “Customize the Ribbon” area.

Control elements are available in the template, which make it interactive. Template users can choose from the list of options and input data themselves. In the travel expense report template, for example, we have used content controls for date selection. You can add additional controls or sections that you require for your accounting, or delete entries that you do not need.

We have also included a header in the template. You can customize this just as you would with Word or any other word processing software. Simply replace the sample entries with your company’s details. In addition, you are of course free to add other design elements such as your company logo to the template.

Employees simply need to open the travel expense report template, fill out the document, and then save it. This requires very little effort, but at the same time the accounting department can easily analyze the information contained. In addition, all parties involved can be sure that all necessary information is provided.

Click here for important legal disclaimers.