What is price elasticity of demand? Formula and explanation

The price elasticity of demand indicates how flexibly the market responds to price changes of a product or service. It is a key metric for making informed business decisions, such as calculating prices.

What is price elasticity?

The most important reference points for pricing in a free market are supply and demand. The price elasticity of demand indicates how sensitive the demand for specific goods or services is to price changes. To determine this, the percentage values for both price and demand changes are calculated and compared.

A price increase normally leads to a decline in demand, as consumers no longer want or can afford to spend money on the product or service in question. Likewise, a price cut often results in greater demand. In these cases, we can observe price-elastic demand because the demand strongly depends on pricing and can fluctuate accordingly.

The situation is different when it comes to price increases for essential goods, such as staple foods, life-saving medications, or rental housing. In these cases, consumers cannot easily forego consumption or switch to substitute products. As a result, demand remains relatively stable even with price increases – a characteristic of price-inelastic demand.

From these examples, it can be concluded that price elasticity primarily depends on whether and how many substitute goods are available. If a good or service can easily be replaced by a cheaper alternative, the price elasticity of demand is very high. Conversely, if customers rely heavily on the consumption good, the price elasticity is correspondingly low.

How to calculate price elasticity of demand

To obtain a comparable value for various goods and services, the percentage change in demand is divided by the percentage change in price. This results in the following price elasticity of demand formula:

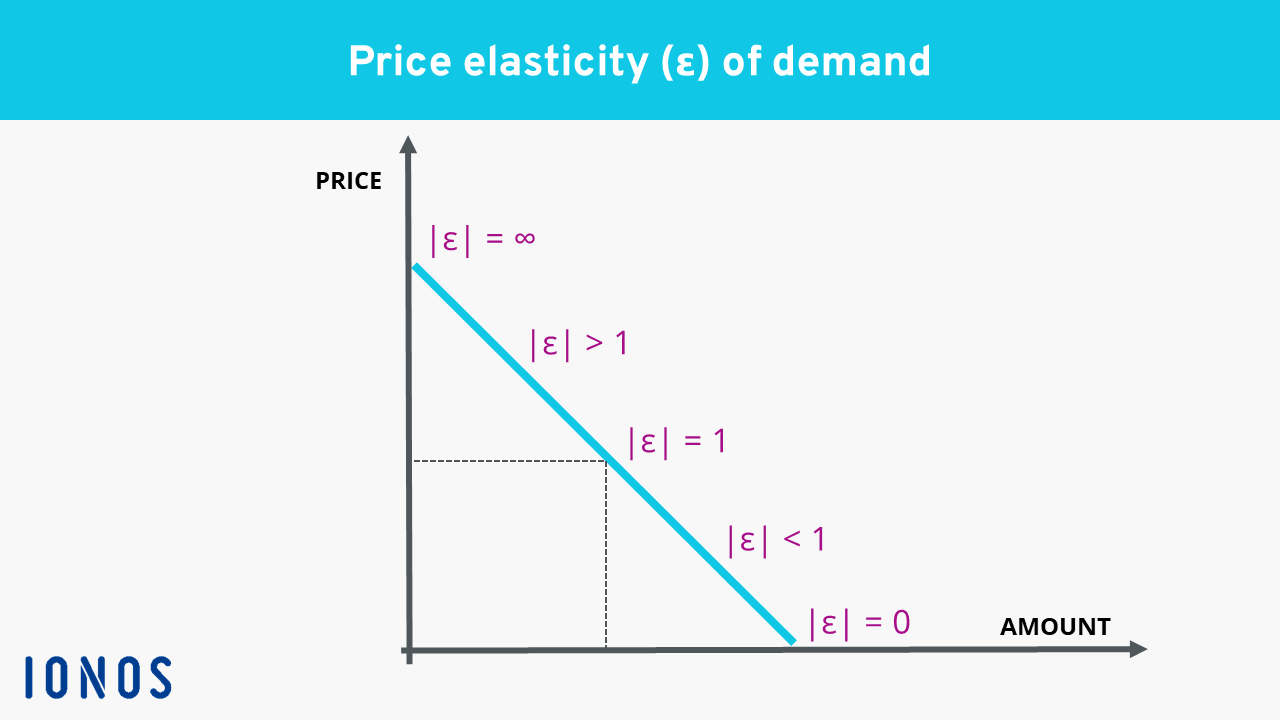

For price-elastic demand, the resulting value is larger than one, whereas the value is less than one for price-inelastic demand. If the value is exactly one, demand and price correlate with each other directly proportionately. In reality, this is very unlikely or only possible as a result of observing price elasticity over just a short period of time. The value zero is likewise exceedingly rare. This value would mean that price changes have no effect on demand whatsoever. A typical example for this completely price-inelastic demand are price increases for vital medicines, like insulin for diabetics.

The following graph shows how price and the quantity demanded correlate:

Example calculation

A baker raises the price of his apple pie from $1.10 to $1.25 per slice. Before increasing the price, he sold 45 apple pie slices every day. Now he only sells 36.

Price increase from $1.10 to $1.25 = 13.6%

Decline in demand from 45 to 36 apple pie slices per day = 20%

Dividing the decline in demand by the price increase results in the value 1.47. Demand is therefore significantly price-elastic. For the baker, this means that he loses more revenue due to the lower sales than he gains with the higher price. Here, it therefore makes more sense to reduce rather than increase prices.

This example shows how a reduction in the sales price for products and services with a high price elasticity of demand can be used to increase the overall revenue of a company.

This consideration should also be kept in mind in relation to the minimum viable product. It plays a key role in determining to what extent the costs of further product development should influence the sales price.

Please note the legal disclaimer for this article.