Partial invoice

What is a partial invoice? A partial invoice is similar to a regular invoice, but with the special feature that it represents only a part of a total invoice. The settlement of larger orders that run over a long period of time (e.g. construction projects) is often divided into several partial invoices, which are paid depending on the progress of the order execution. The advantage for the contractor is that they do not have to pre-finance the entire contract. This also reduces the risk of a complete default.

The advantage for the client is that the contractor is encouraged to carry out the individual order services punctually and error-free. The amount and frequency of partial invoices is determined by the type and timing of the agreed delivery or service.

A partial invoice comprises a part of the total invoice for a delivery or service whose execution extends over a certain period of time and which is subdivided into corresponding partial services. There is no legal regulation for the amount of partial invoices; they are negotiated between the customer and the contractor. In contrast to regular invoices, partial invoices can vary in amount.

Areas of application and purpose of partial invoices

In the construction industry, partial invoices are widely used. Construction projects usually extend over a certain period of time, and, taking into account the expected progress of construction, acceptance and correspondence payments are agreed in advance invoices. A down payment invoice, which the customer pays before beginning construction, is also common.

In other trades and in plant construction, partial invoices are used above all when longer-term projects are involved. Here, too, down payments before the start of the project are not uncommon, which is usually followed by an interim invoice as soon as the first agreed service has been rendered and accepted.

However, partial invoices are also not uncommon for other types of orders in many industries: self-employed people who carry out long-term orders often agree on partial invoices with their customers in order to secure a regular income. In return, clients agree to advance invoices with companies in order to better plan their payments over time. This means that both sides often benefit from an even cash flow in partial amounts.

What a partial invoice should contain

A partial invoice does not differ in its basic form from any other invoice. But there are a number of required components, which must not be missing on any partial invoice.

First, a partial invoice must be clearly identified as such, including its serial number (1st or 2nd partial invoice, etc.).

The other mandatory details generally apply to every invoice:

- Name and address of both the seller and recipient, including date of sale

- Merchandise point of entry destination (if goods have been imported)

- Merchandise country of origin (if applicable)

- Date of issue

- Consecutive invoice number

- Time of delivery/performance of the service

- Product/service details (description, quantities, additional charges)

- Tax rate

- Net amount

- Sales tax amount (if applicable)

- Gross amount

In addition, it won’t do any harm to add a statement of settled and outstanding installment payments. If you create a final partial invoice, the settlement of which concludes the payment of the total amount, you must attach the total invoice and note all partial invoices made so far in it. The last partial invoice therefore contains a final invoice if the full service has been rendered.

How much should a partial invoice be?

There is no legislation in place determining the amount that can be requested in a partial invoice. Contractual partners should agree before the start of a project when invoices are due, and how payments will be broken down. However, variables may occur and must be run by the customer. Typically, project phases or sub-projects are defined, each of which is concluded with a corresponding partial invoice and the amount of which depends on the respective service or is agreed in advance. The following factors can influence the amount of a partial invoice:

- Agreed advance: The customer and the representative often negotiate an advance invoice, which is then taken into account in future partial invoices. An advance payment logically reduces the amount of the first (and possibly subsequent) installment payments, or the first time of the first installment invoice after the start of the project is placed in the distant future due to the advanced payment.

- Material costs, personnel costs, administrative costs: As far as these are costs are concerned, it is important to be absolutely transparent with the customer – especially if invoice amounts have not been fixed in advance. Certainly, negotiating skills also play a role here.

- The amount of the partial invoices will, of course, determine the occasions for which partial invoices are sent within the project (completion of subprojects, etc.). The project planning should also include the costs for the individual phases so that the customer can realistically estimate the amount of the partial invoices in advance. It is also conceivable to design the project in such a way that the frequency and amount of the partial invoices meet the customer’s expectations.

Errors that should be avoided when it comes to partial invoicing

- Do not forget the mandatory information.

- Each partial invoice normally contains the individually calculated tax on sales/purchases, which you must also pay separately to the tax office (if applicable to your State). Do not take this into account with the final invoice!

- Document all partial invoices in detail in the final invoice.

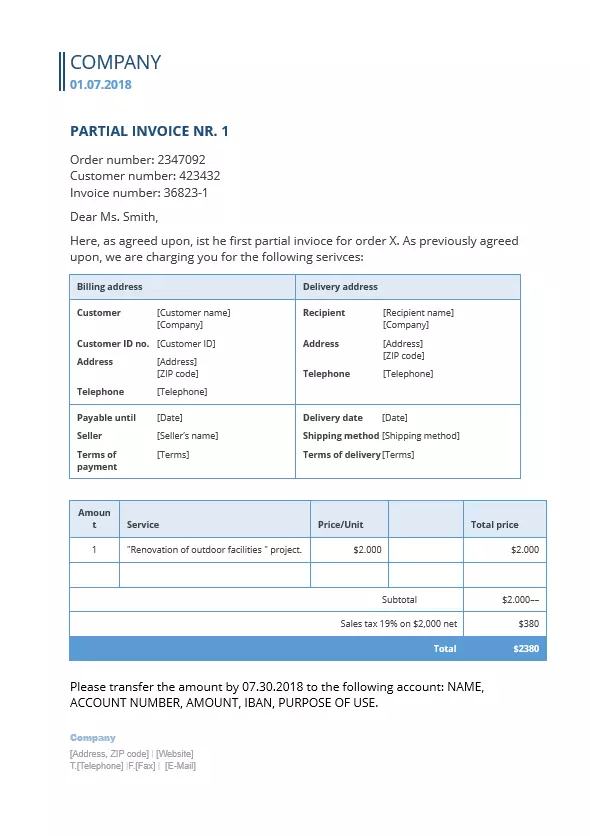

Example of a partial invoice

Normally, you can use existing invoice patterns easily. All you have to do is flag the invoice as a partial invoice and, if necessary, add further details, such as the number of the partial invoice if it is one of several. If the budget billing invoice is the last one to complete the payment for the service, you also add the full invoice. The following is an example of a partial invoice.

Click here for important legal disclaimers.